What is the Difference Between a Fundraiser and a Donation?

Definition of Fundraiser

A fundraiser is typically an organized event or campaign aimed at collecting money for a specific cause. These activities often involve multiple contributors and can range from small local events to large-scale online campaigns. Fundraisers can be organized by individuals, groups, or organizations to support a variety of causes, including medical expenses, community projects, and nonprofit initiatives.

Definition of Donation

A donation refers to the act of giving money or goods to a charitable organization or individual without expecting anything in return. Donations can be made directly to charities, through donor-advised funds, or via other mechanisms. Unlike fundraisers, donations are generally straightforward gifts made to support a specific cause or organization.

Key Differences in Purpose and Structure

The primary difference between fundraisers and donations lies in their purpose and structure. Fundraisers are organized efforts to collect funds from multiple sources, often for a specific, time-bound cause. Donations, on the other hand, are individual acts of giving, typically made directly to a charity or individual. Understanding these definitions helps clarify the subsequent tax implications.

Are Donations Tax-Deductible?

Eligibility for Tax Deductions

In the United States, donations made to qualified charitable organizations are generally tax-deductible. To qualify, the organization must be recognized by the IRS as a tax-exempt nonprofit entity, such as a registered 501(c)(3) organization. Donations to certain religious institutions, government entities, and private foundations may also be eligible for tax deductions.

Itemizing Deductions on Tax Returns

To claim a tax deduction for charitable donations, donors must itemize their deductions on their tax returns. This involves listing each charitable contribution on Schedule A of the IRS Form 1040. It’s important to keep detailed records and receipts for all donations, as the IRS may request documentation to substantiate the deductions.

Limits on Deductible Amounts

The IRS imposes limits on the amount of charitable contributions that can be deducted. For cash donations to qualified public charities, donors can generally deduct up to 60% of their adjusted gross income (AGI). For donations of appreciated assets like stocks or real estate, the deduction limit is typically 30% of AGI. These limits can vary based on the type of contribution and the recipient organization. For more details, refer to the IRS guidelines on charitable contributions.

Are Funds Raised Through Personal Fundraisers Tax-Deductible?

Personal Fundraisers vs. Charitable Organizations

Funds raised through personal fundraisers, such as those on platforms like GoFundMe, are generally considered personal gifts and may not be tax-deductible for the donor. The IRS views these contributions as personal gifts rather than charitable donations, which affects their deductibility.

Tax Treatment of Personal Gifts

Personal gifts are not eligible for tax deductions. This distinction is important for both donors and recipients to understand. While personal fundraisers can provide much-needed financial support, they do not offer the same tax benefits as donations made to qualified charitable organizations.

Potential Reporting Requirements

Donors who contribute large amounts to personal fundraisers should be aware of potential reporting requirements. For example, gifts exceeding the annual exclusion amount (currently $15,000 per recipient) may require the donor to file a gift tax return. Recipients should also be aware of any potential tax implications, although most personal gifts are not considered taxable income.

What Are the Tax Implications for the Recipient of Funds Raised?

Tax Treatment of Fundraising Income

The tax implications for recipients of funds raised through personal fundraisers can vary. Generally, funds received as personal gifts are not considered taxable income. However, if the funds are used for a business or involve certain conditions, different tax rules may apply. It’s important for recipients to understand the specific tax treatment of their fundraising income.

Gift Tax Considerations

For donors, the IRS imposes an annual gift tax exclusion, allowing individuals to give up to a certain amount ($15,000 as of 2021) to any number of recipients without incurring gift tax. Gifts exceeding this amount may require the donor to file a gift tax return. For recipients, the funds received as gifts are typically not subject to income tax.

Reporting Requirements for Fundraisers

Recipients of fundraising income should maintain accurate records of the amounts received and their intended use. This documentation can help ensure compliance with tax regulations and provide clarity in the event of an IRS inquiry. For specific advice, it’s recommended to consult a tax professional.

What Documentation is Needed for Tax Purposes?

Record-Keeping for Donations

Donors should keep detailed records of their charitable contributions, including receipts, acknowledgment letters, and any other documentation provided by the charity. These records are essential for substantiating tax deductions and ensuring compliance with IRS requirements.

Documentation for Fundraisers

Recipients of fundraising income should maintain detailed records of the amounts received, the sources of the funds, and their intended use. This documentation can help ensure compliance with tax regulations and provide clarity in the event of an IRS inquiry.

Importance of Accurate Reporting

Accurate reporting is crucial for both donors and recipients. Donors need to ensure their contributions are correctly documented to claim tax deductions. Recipients must track and report the funds received to comply with tax regulations and avoid potential issues with the IRS.

Conclusion

Understanding the tax implications of fundraisers and donations is essential for effective financial planning and compliance with tax laws. By addressing these FAQs, individuals can navigate the complexities of charitable giving and fundraising with greater confidence. For those seeking further information, consulting a tax professional is recommended to address specific circumstances and ensure adherence to IRS guidelines.

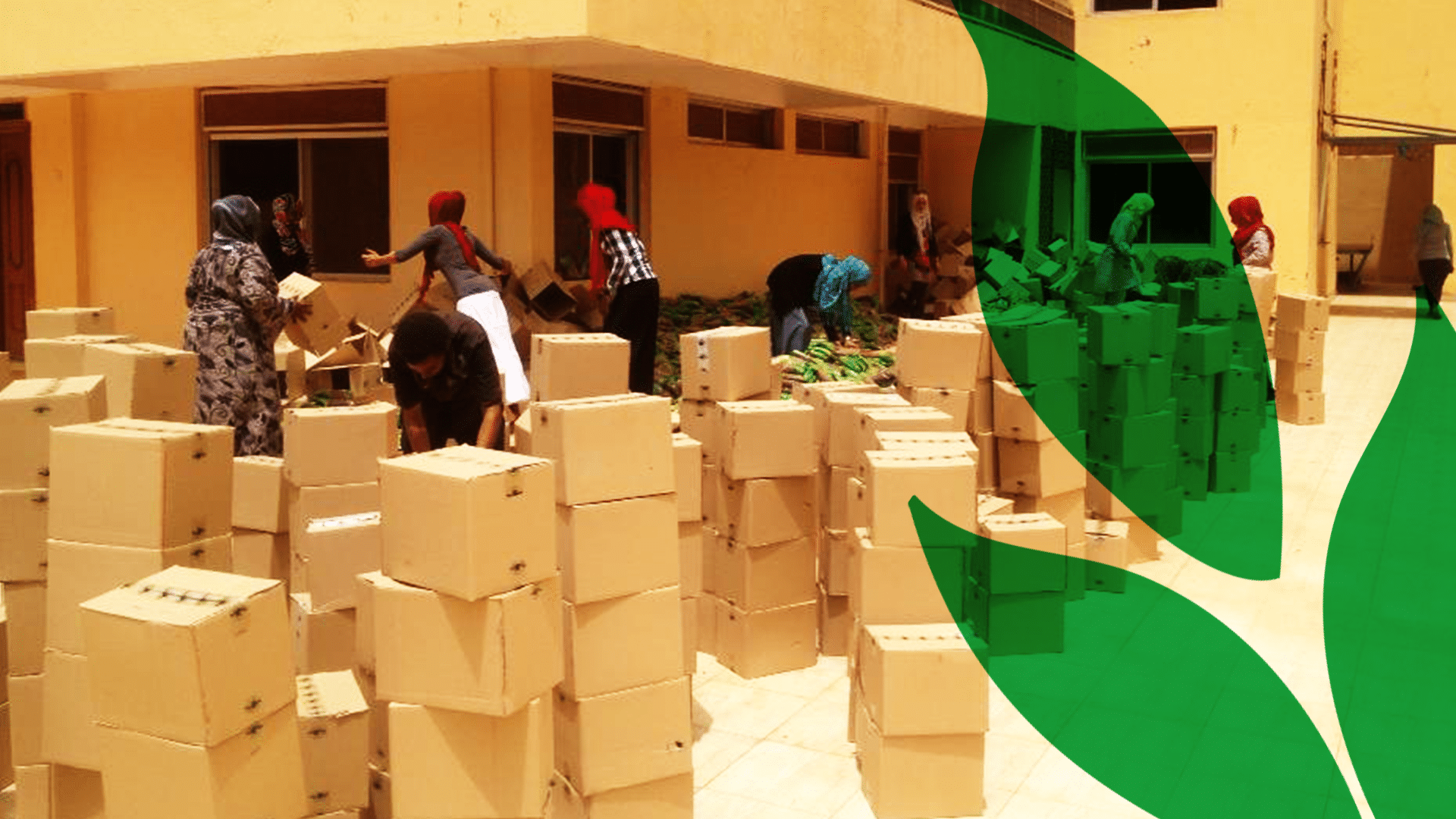

By following these guidelines and leveraging available resources, you can ensure that your charitable donations and fundraising efforts are impactful and aligned with your financial goals. For more information on how you can help, visit Sadagaat-USA. Your contribution can make a significant difference in the lives of those in need in Sudan.